Singapore Skincare Market Research: Global Brands Are Fiercely Competing

2022-07-25 | 李苑婷

According to Statista, Singapore skincare market will reach nearly US$300 million in 2022, with a CAGR (compound annual growth rate) of 2.41% till 2026. Singapore's per capita income is high, and the annual expenditure on skincare products per capita is also the highest among ASEAN countries. However, if brands rush into the local market without understanding it, they may face many problems. In this research, i-Buzz Asia will shed light on the matters of what popular skincare products in Singapore are, how competitive Singapore skincare market is, and what kinds of effects and skin problems are the most concerned about by the local people?

Skincare Product WOM Volume Analysis: Local consumers are the most interested in essence and serum - and pay more attention to the moisturizing effect.

Of a wide variety of skincare products, essence and serum are the most discussed and also the most popular skincare products in Singapore skincare market. The weather in Singapore is hot and humid the whole year, making consumers have a high demand for moisturizing products. However, this also makes local consumers afraid of using skincare products with a certain degree of stickiness. Therefore, with a light texture and a high concentration of good ingredients for skin, essence has become Singaporeans’ favorite skincare product. In addition to using essences for skin moisturizing, Singaporean consumers are also interested in serums for different specialized skin beauty effects such as hydrating, cleansing, anti-aging, etc., and accordingly provide solutions to specific skin problems. Followed by other popular skincare products including sunscreen, toner, face cleanser, eye cream, lotion, and so on.

Popular Brands in the Market: Global brands are fiercely competing! Western, Japanese, and Korean brands dominate the skincare market.

i-Buzz Asia has further researched popular brands in Singapore skincare market to let you know how competitive this market is. See that, Singapore is highly open to global brands. Consequently, there are many global brands fiercely competing in Singapore, and the most competitive brands could mention Lancome, Origins, Laneige, Clarins, Estee Lauder, Innisfree, Clinique, Benefit, Dior, and Shu Uemura. Most of these brands are from Western countries, Japan, and South Korea, such as Lancome, Clarins, and Dior from France; Origins, Clinique, Estee Lauder, and Benefit from the US; Laneige and Innisfree from South Korea; Shu Uemura from Japan. Among them, Lancome and Shu Uemura all belong to L’Oreal Group, while Origins and Clinique belong to Estee Lauder Group. Thus, it is advised that skincare brands that would like to enter this market should prepare themselves mentally for the competition in the market.

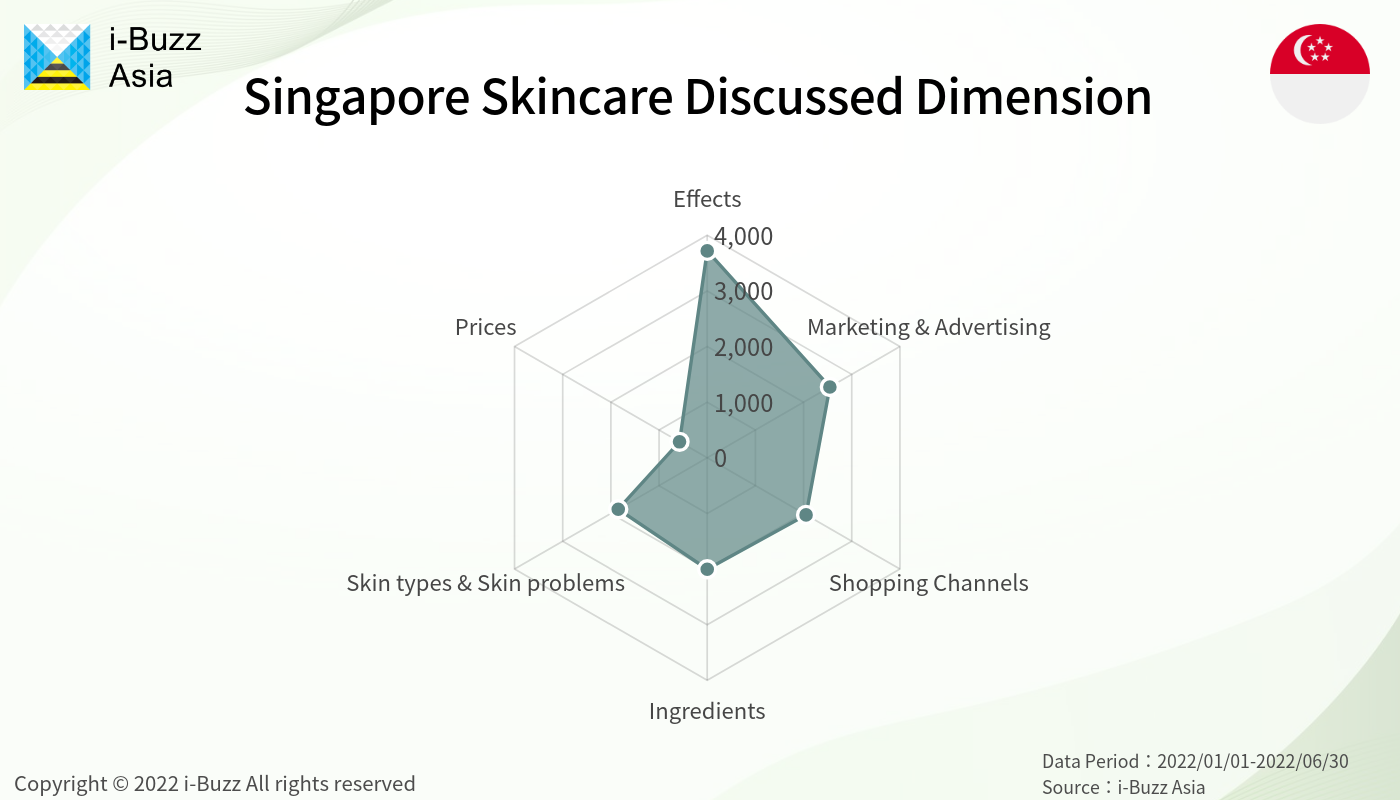

Discussed Dimension Analysis: High price is not a problem – Discounts and trial products are helpful for sales increase.

What aspects of skin care products do local consumers pay attention to? As i-Buzz Asia data, the discussed topics of Singapore skincare products are divided into six dimensions including Effects, Marketing & Advertising, Skin types & Skin Problems, Shopping Channels, Ingredients, and Prices. Skincare product effects are the most discussed by Singapore consumers, followed by marketing & advertising, and prices are the least discussed by the locals. Singaporeans pay special attention to skincare product effects and are intended to discuss and look for skincare products that meet their requirements online. On the other hand, consumers are less concerned about skincare product prices and are interested in brands’ marketing and advertising instead. Furthermore, discounts and free trials are effective in attracting attention and increasing sales.

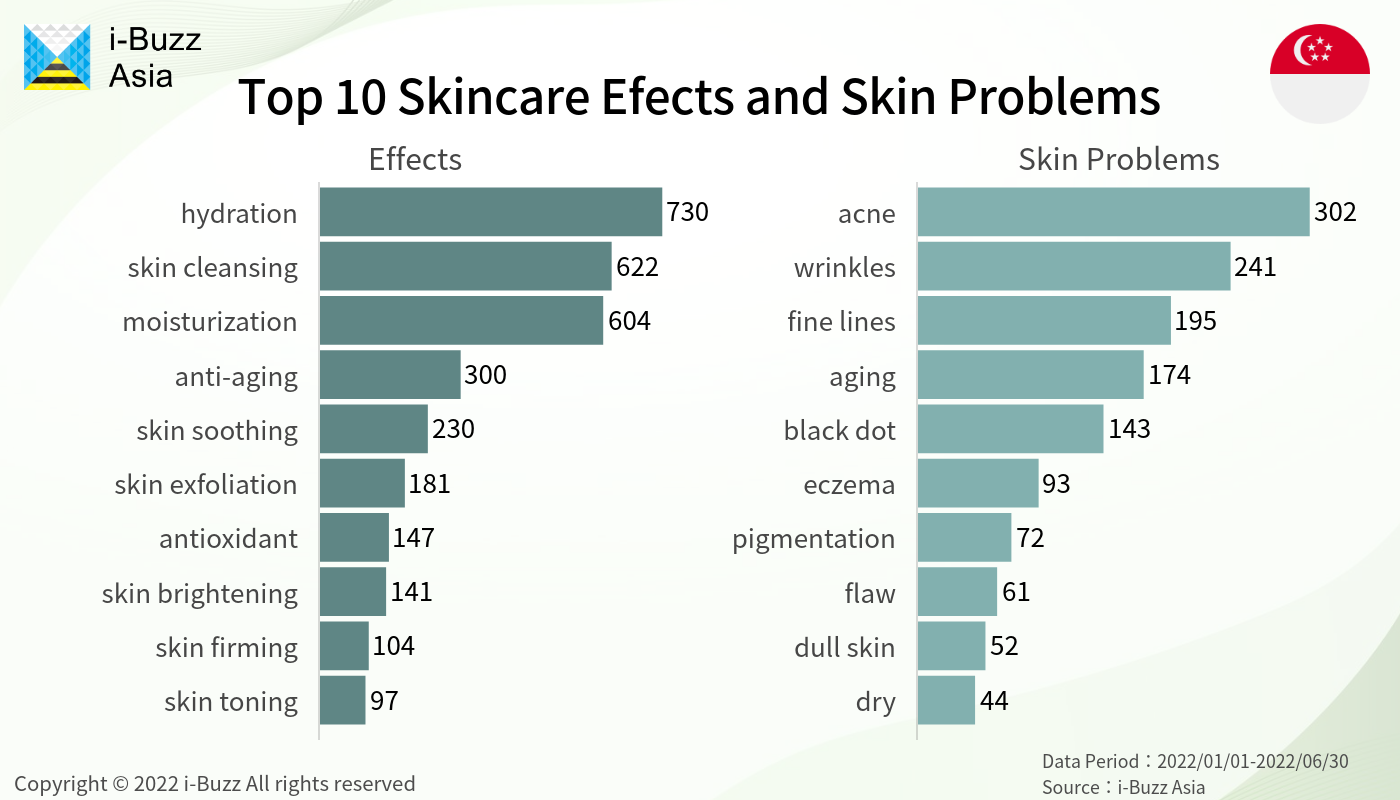

Top10 skincare effects and skin problems: Most are concerned about acne and aging problems -Moisturizing, anti-acne, and anti-aging are major segments in the market

As mentioned, Singapore consumers are very concerned about skincare product effects, thus i-Buzz Asia further analyzes the Top 10 popular skincare effects and skin problems in Singapore. As i-Buzz Asia findings, acne and aging are the most encountered skin problems of Singaporeans, affecting how they seek skincare effects. While skin cleansing or skin exfoliation is more paid attention to due to acne-related problems, aging problems such as wrinkles and fine lines attract more interest in the effects of anti-aging, anti-oxidants, and skin firming, especially moisturizing. This creates three major segments including moisturizing, anti-acne, and anti-aging in the market.

There is fierce competition in the market – Capturing market keywords is the key to success!

i-Buzz Asia's Singapore Skincare Market Research found that essences and serums are the most popular in Singapore skincare market, and most well-known skincare brands are global brands from Western countries, Japan and South Korea. New followers have to face fierce competition from first movers which are global brands in Singapore skincare market. It is worth mentioning price does not matter to the high-income Singaporean market. As i-Buzz Asia data, moisturizing, anti-acne and anti-aging are important Singapore consumer needs. Hence, brands should launch products solving consumers’ these specific skin problems. In addition, marketing and advertising activities are always very effective to attract local consumers’ attention and accordingly can increase brand visibility.

© 2023 亞洲指標數位行銷顧問股份有限公司. 版權所有